Within the current consumer landscape, a complex interplay of consumer behavior and sustainability practices is evolving. It is a world where taste, ethics, and environmental consciousness intersect, influencing not just purchasing decisions but also production practices.

This evolution of consumer consciousness is playing out in a myriad of products and services and the beef industry is no exception. Through the data, we unravel the multifaceted tapestry of consumer preferences, environmental considerations, and the crucial role of trust in the beef industry.

Understanding the Shift Towards Sustainability

Central to our exploration is the discernible shift in consumer consciousness towards sustainability. In recent years, there has been a palpable surge in consumer demand for products that echo their environmental values. This is evident in the burgeoning popularity of sustainable alternatives, such as reusable bags, and the increasing preference for products boasting natural, eco-friendly ingredients.

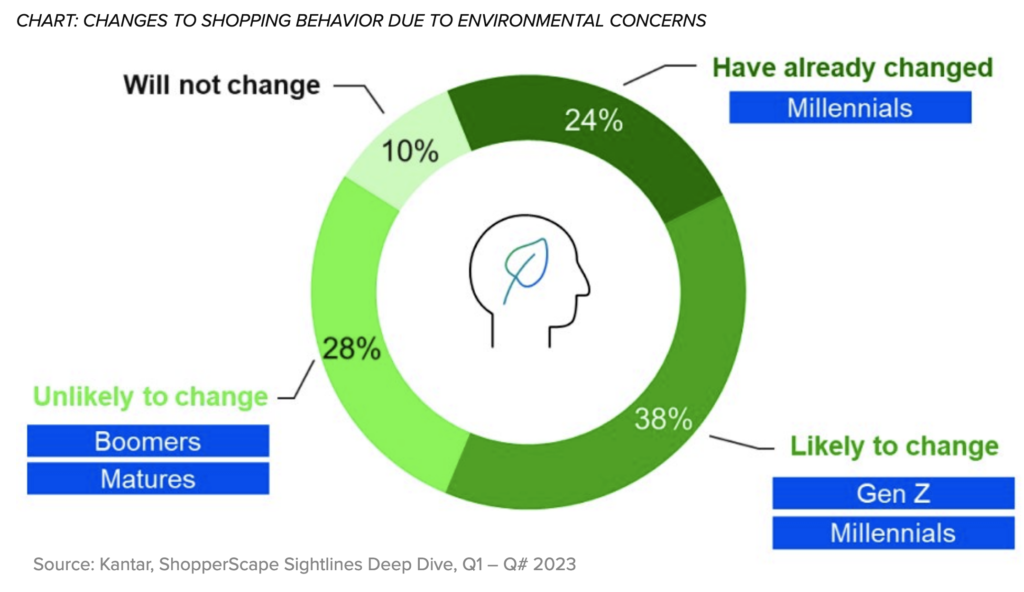

Recent surveys reveal a significant portion of consumers actively engage in behaviors that support environmental causes. More than half of shoppers have already changed or are likely to change their shopping behavior due to environmental concerns. ¹ From reducing single-use plastics to opting for products with sustainable attributes, consumers are signaling a broader shift towards greener, more eco-conscious shopping habits.

This shift towards sustainability is not just a passing fad; it is a fundamental reorientation of consumer values. As concerns about climate change and environmental degradation intensify, consumers are increasingly seeking out products that align with their ethical and environmental principles. The question for the beef industry is are these general consumer trends specifically impacting beef consumers, and if so, how can operators respond accordingly.

Navigating the Path of Sustainability

As consumers pivot towards sustainability, manufacturing practices and ingredient sourcing come under scrutiny. This heightened awareness of sustainability considerations underscores the growing demand for transparency and accountability within the beef industry. A 2022 Kearney study found that in the last five years, Google searches about the carbon footprint of beef have increased by 18%. ²

Consumers want to know not just where their beef comes from but also how it is produced. This presents an opportunity for supply chain operators to embrace more sustainable practices, from sourcing strategies to packaging materials, and to communicate these efforts transparently to consumers.

Even though consumers have increasing awareness regarding beef sustainability, it does not mean that their sentiment is negative. Recent results from NCBA’s Consumer Beef Tracker, a contractor to the beef checkoff, reveal that relative to other proteins, beef ranks #1 as supporting causes important to consumers. ³

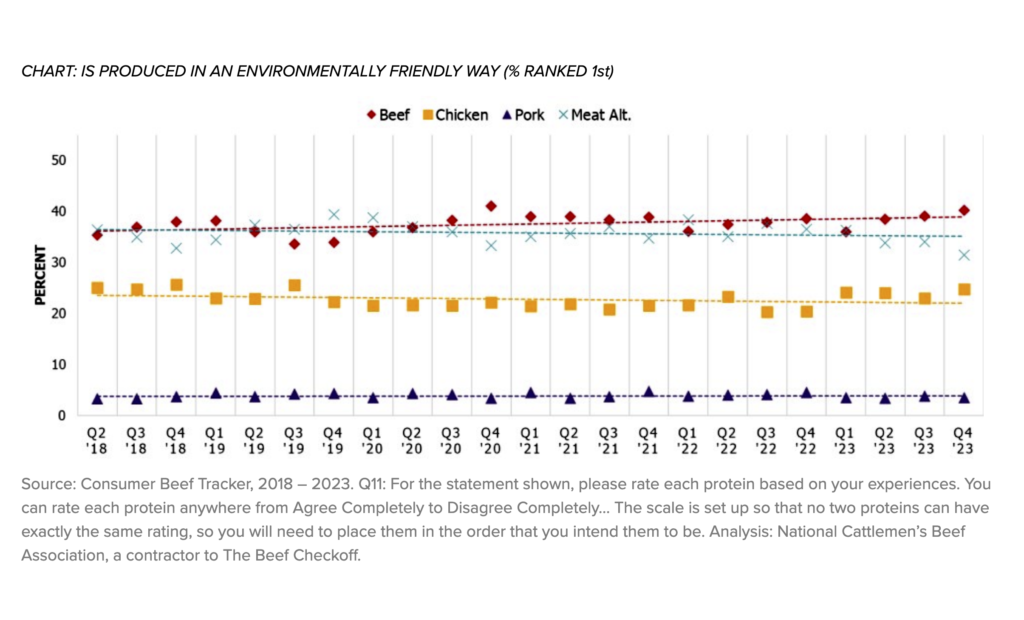

Further evidence shows that consumers consistently perceive production of beef to be the most environmentally friendly with meat alternatives in second place. ⁴ Moreover, beef’s lead over meat alternatives has been steadily increasing since 2019. ⁴

The Role of Trust in Beef Production

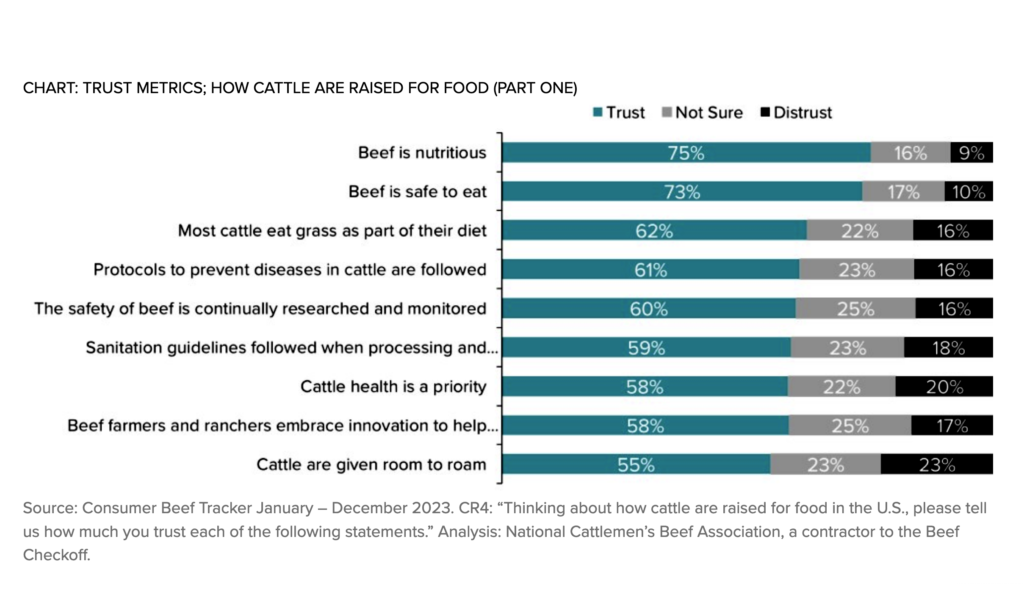

Trust is the bedrock upon which consumer confidence in the beef industry rests. Consumers increasingly want assurance that the beef they purchase is not only safe and nutritious but also produced responsibly and ethically. In fact, over 70% of consumers trust that beef is nutritious and safe to eat. ⁵ However, there are areas where operators can improve communications to help elevate trust within consumer perceptions about how cattle are raised. Looking at the same data set, consumers surveyed reported lower levels of trust when asked if cattle health is a priority and if cattle are given room to roam. ⁵

Consumers tend to place an elevated level of trust in sources such as veterinarians, farmers, and government institutions. Amongst the consumers surveyed, veterinarians, farmers, and ranchers scored the highest at 62%, with organizations like the USDA-FDA and the CDC (Centers for Disease Control and Prevention) placing third and fourth at 57% and 53%, respectively. Anecdotally, large media outlets such as The New York Times and Fox News ranked last at 26%. ⁶

This emphasis on credible sources underscores the importance of transparency and reliability in building consumer trust within the industry. By fostering open communication and providing verifiable information about production practices, industry stakeholders can strengthen consumer trust and confidence in the beef supply chain.

Sustainability Is Only a Small Part of the Consumer Mindset

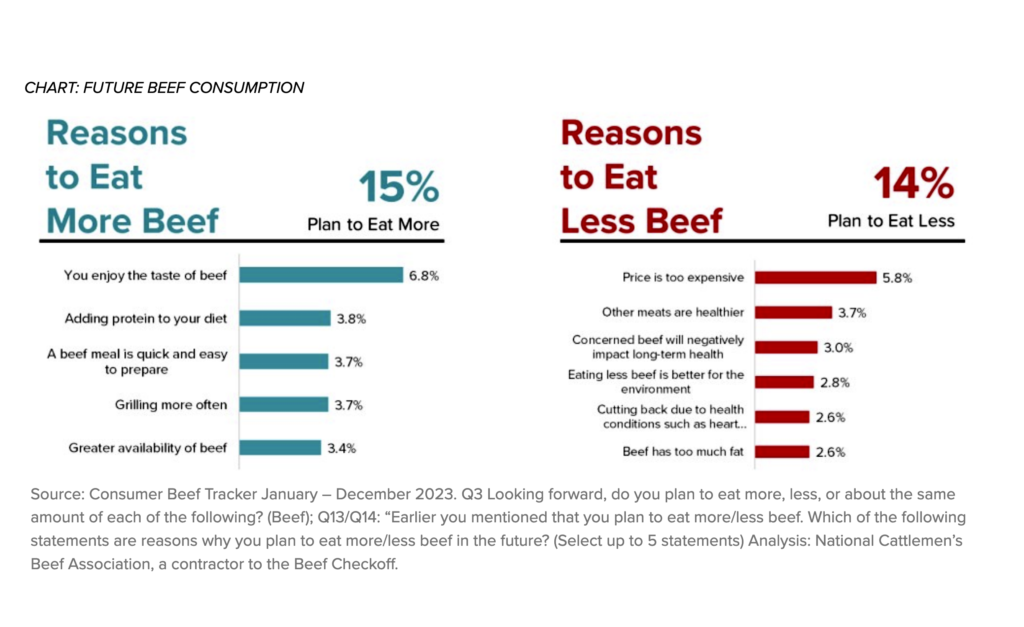

Despite concerns about health and sustainability, there are several factors that rank higher in terms of why consumers choose to purchase beef over other proteins. Data from the Consumer Beef Tracker reveals that taste, convenience, and nutritional value continue to drive consumer preferences when it comes to beef products. A full 80% of consumers plan to maintain or eat more beef in the future. Of the 15% that plan to eat more, they cite reasons such as taste, adding protein to their diet, and the fact that beef is quick and easy to prepare. Unsurprisingly, of the 14% who plan to eat less, their reasons include higher prices, other meats are healthier, and health concerns. Interestingly, only 2.8% of that group cites ‘Eating Less Beef is Better for the Environment’ as a reason to eat less. ⁷ This simple fact illustrates that although sustainability concerns amongst consumers are growing, it remains a small motivator when it comes to beef consumption.

Conclusion

The data from the Consumer Beef Tracker provides valuable insights into the evolving landscape of consumer behavior and sustainability in the beef industry. As consumers increasingly prioritize sustainability and transparency, there is a need for supply chain operators to understand and share more about how beef is raised for food, and for the industry to stay committed to continually improving its environmental, economic and social responsibility.

1. Kantar, ShopperScape Sightlines Deep Dive, Q1 – Q# 2023

2. Consumer awareness of food’s environmental impact is slowly growing, Food Dive // Dawn of the Climavores, Kearney; April 2022

3. Consumer Beef Tracker, 2018 – 2023. Q11: For the statement shown, please rate each protein based on your experiences. You can rate each protein anywhere from Agree Completely to Disagree Completely… The scale is set up so that no two proteins can have exactly the same rating, so you will need to place them in the order that you intend them to be.

4. Consumer Beef Tracker, 2018 – 2023. Q11: For the statement shown, please rate each protein based on your experiences. You can rate each protein anywhere from Agree Completely to Disagree Completely… The scale is set up so that no two proteins can have exactly the same rating, so you will need to place them in the order that you intend them to be.

5. Consumer Beef Tracker January – December 2023. CR4: “Thinking about how cattle are raised for food in the U.S., please tell us how much you trust each of the following statements.”

6. Consumer Beef Tracker January – December 2023. SI3: Please tell us how credible you find each of the following sources of information regarding the US meat industries’ production practices. (Top 2 Box).

7. Consumer Beef Tracker January – December 2023. Q3 Looking forward, do you plan to eat more, less, or about the same amount of each of the following? (Beef); Q13/Q14: “Earlier you mentioned that you plan to eat more/less beef. Which of the following statements are reasons why you plan to eat more/less beef in the future? (Select up to 5 statements)

Courtesy of Beef. It’s What’s For Dinner | Makenzie Neves, Manager, Producer Education & Engagement